• Portfolio index lists for a sicav company, investment funds, ETFs

When managing savings money it is imperative to try to get the most out of it. The companies could increase the offer by adding to their management lists produced by research centers specialized in strategic directions.

A know-how that can be transferred effectively by means of ad hoc reports. Studioeconomia creates portfolio index lists for equity investment and management companies: stock lists organized in rankings by weights for replication for low-risk, high-return performance.

Equity management is best performed with securities trading sessions scheduled with dates in advance, with a frequency of 10 days designed to successfully manage a fund, even private unlisted ones, and place it in the top 10% of national funds. The relationship with the company is carried out by means of portfolio list reports. Periodic reports studied in detail for this purpose are sent by 10.30.am of each expiry date to allow the manager to reply on the same day.

The reports are drawn up according to technical reporting schemes consisting of:

- fixed number of titles expressed with % weights.

- trades to be carried out indicated in specific denominations as a % of the total or in multiples thereof. For example, if the transaction size is 2.5%, all transactions will be 2.5% of the total or multiples of them.

- Optimization of securities rotations (incoming and outgoing securities) and the total number of transactions.

- Lists including a liquidity balance in % of the total.

Estimated total of transactions to be performed in the year to replicate the index: 500 for + lists, 100 for LT lists

The basic offer consists of a service of sending portfolio index reports according to a pre-set calendar. The consultancy is strictly limited to the investment strategy and does not involve direct relationships with customers. The material execution of the sales is the responsibility of the managing company.

type of collaboration: professional contract

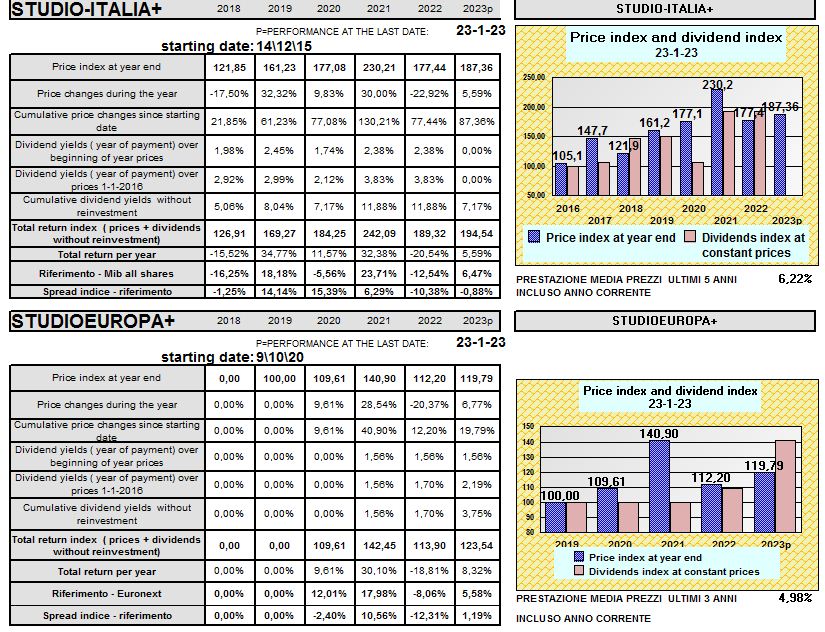

The Studioitalia+ and Studioeuropa+ list.

The studio+ list are portfolios of 18/20 securities selected from the manufacturing and service sectors among medium/high-sized companies on the Italian stock exchange or European stock exchanges that meet company management quality criteria as well as income growth and market status (momentum ). A list designed for investment companies and asset and fund management organizations including ETFs. It is inspired by the principle of building portfolios with fine growth in returns while at the same time providing for adequate diversification and risk reduction by means of appropriate techniques of value and market state analysis (momentum).

The list has been in existence since 2015.

Reference index: Studioitalia+ : Mib all shares

Studioeuropa+: Euronext

components: 18/20

risk level: medium

estimated no of trades per month* : 35

average amount of trades: 3% of the invested capital

frequency of reports: 10 days

*) the number of trades corresponds to the market operations to be carried out to replicate the index between two periods based on the amount invested at the date of the report.

List of Studioitalia LT and Studioeuropa LT

The LT lists draw on the same Italian and European securities base where the term LT indicates long term. The LT lists are studied in terms of growth, quality of management and price-value analysis but do not include price momentum analysis.

The LT lists are favored by some as they look purely at the earnings value of the securities regardless of the market state. Therefore they require much less market treatment (less than 1/3 in terms of number of transactions).

Reference index: MIB or Euronext

components: 18/20

risk level: medium

estimate no of trades per month* : < 10 ;

average amount of trades: 2.75% of invested capital

frequency of reports: 10 days

The lists have been in existence since August 22.

Costs:

------------- LISTS + --------------

SGR

Year 1 : €10,000

year2 and following : 1/000 of the mass managed subject to a minimum (price year1 + 20%)

SIM - PRIVATE COMPANIES

Year 1 : €7500

year2 and following: 1/000 of the managed mass subject to a minimum (year1 price + 20%)

---------- LT LISTS -----------

SGR

Year 1 : €7,500

year2 and following : 1/000 of the mass managed subject to a minimum (price year1 + 20%)

SIM - PRIVATE COMPANIES

Year 1 : €6,000

year2 and following: 1/000 of the managed mass subject to a minimum (year1 price + 20%)

requirements to operate with SGR

Studiofinanza does not handle third-party money or mandates to manage or operate on behalf of clients. Portfolio index lists are not UCI instruments. The SGRs must all

requirements for operating with SGR

Studiofinanza does not carry out retail consultancy with the public, does not handle third party money nor sent to manage or operate on behalf of clients and the service does not fall within the UCITS activities. however, asset management companies must verify that the operators and partners with whom they operate meet the criteria of integrity and professionalism. The following are therefore available for this purpose:

Declaration pursuant to the law DM n. 206 of 2008

Curriculum vitae and studies of the director

Publications

Document description of the analysis methodology

Possible professional liability insurance on request

Contact Studiofinanza for more news